China

At the 2024 Mobile Robot Industry Alliance awards ceremony, the integrated servo wheel module from Hangzhou System Technology stood out among hundreds of products, winning the "Excellence in Supply Chain" award. This highly integrated drive unit not only entered smart factories of giants like Huawei, BYD, and Xiaomi but also penetrated Southeast Asia, replacing a decade-old German IPC solution for an AGV manufacturer—slashing costs by 40% and compressing lead times from 8 weeks to 3. This case epitomizes Chinese electromechanical enterprises’ strategic leap: a historic shift from component OEM to technology standard exports.

I. Price Undercutting: The "Ceiling Dilemma" of Traditional OEM Models

China’s electromechanical exports have long been trapped in a "high volume, low value" cycle. In H1 2024, China’s cross-border e-commerce import-export volume hit ¥1.22 trillion ($168B), up 10.5% YoY, yet profit margins kept shrinking. Hebei’s trade data reveals the transformation direction—from January to April 2024, its trade with Belt and Road Initiative (BRI) countries accounted for 57.9% of its total foreign trade, with high-value electromechanical products and auto parts replacing low-end goods as new export drivers.

Behind this shift lies brutal pressure: as auto parts companies flood overseas markets, the industry predicts that "within 2–3 years, overseas markets will be red oceans for Chinese manufacturers." The single-hardware sales model faces three traps:

-

Profit ceiling: Gross margins for universal servo controllers remain below 15%

-

Homogeneous competition: Over 50 similar manufacturers cluster in East China industrial belts

-

Low-value positioning: Western firms capture >30% premiums via protocol licensing fees

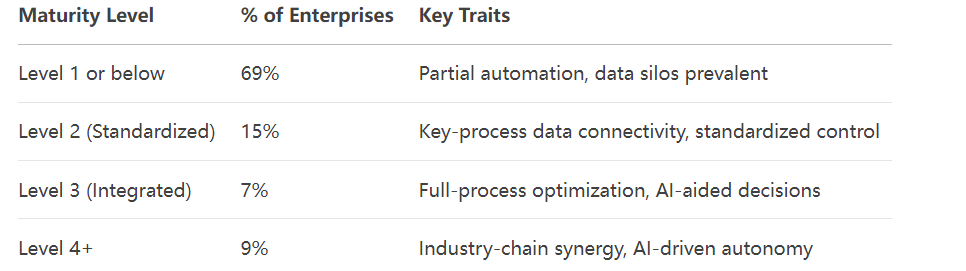

Table: Smart Manufacturing Capability Maturity Distribution in China (2021)

II. Breaking the Mold: System’s Full-Stack Solution in Global Markets

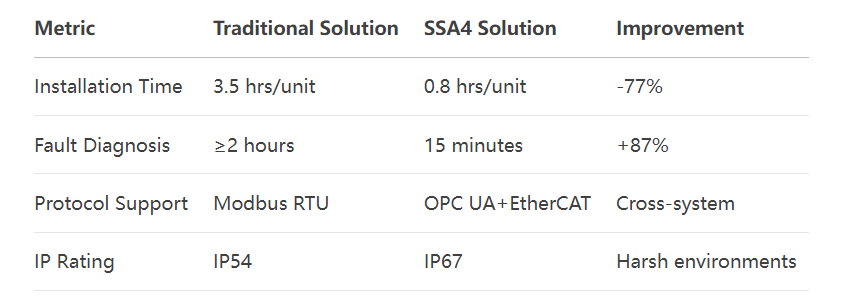

As a motor control specialist under Silan Microelectronics, Hangzhou System’s transformation is emblematic. Initially an OEM servo controller supplier, it now deploys its SSA4 integrated servo wheel module, achieving four breakthroughs:

-

Hardware Integration Innovation

Integrating drives, motors, gearboxes, and wheels into one unit reduces AGV chassis space by 40%, while anti-interference enhancements cut failure rates by 25%. Its dual-encoder design holds CE certification, complying with EU standards. -

Protocol Layer Breakthrough

For Southeast Asian AGV clients, it embedded OPC UA-compatible protocol stacks into hardware, interfacing directly with existing MES systems to replace German Beckhoff IPC solutions. This hardware-software integration reduced client TCO by 40%, while System’s margins rose 12 percentage points. -

Cross-Border E-Commerce Ecosystem Leverage

Using Alibaba.com’s AI tools to pinpoint Southeast Asian demand and leveraging Loctek’s overseas warehouses for localized delivery, System’s integrated solutions hit 10,000+ units in 2024, with overseas revenue share jumping from 15% to 34%.

Table: Performance Comparison of System’s Integrated Servo Wheel Module

III. Ecosystem Foundations: Cross-Border E-Commerce’s "Triple Jump"

To export technical standards, Chinese electromechanical firms require digital trade infrastructure. With global cross-border e-commerce projected to hit $2.6 trillion (¥18T) by 2025, Chinese players are rebuilding competitive moats via three ecosystems:

-

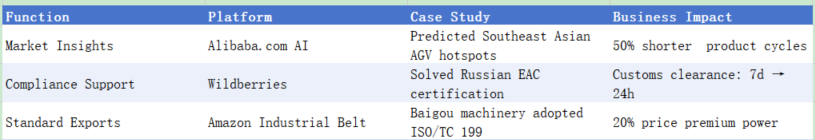

Precision Matching Ecosystem

Linyi’s Cross-Border E-Commerce Summit champions an "AI + Industrial Belt" model. Alibaba.com’s AI tools offer buyer credit analysis and demand forecasting for hardware and machinery sellers, boosting matching efficiency by 300%. Its new AI training bases upskill 3,000 tech-savvy cross-border operators annually. -

Logistics Fulfillment Ecosystem

U.S.-based Wind Thunder Group established warehousing hubs in Hebei, guaranteeing "48-hour delivery to major North American cities." Its CEO stated at Langfang Trade Fair: "Our warehouses in six North American ports make us Hebei’s bridgehead for global expansion." -

Rule-Making Ecosystem

As Zhang Yansheng of China Academy of Macroeconomics stresses: "Cross-border industrial clusters must unite to seize international pricing power, rule-making rights, and discourse power."* After entering China, Wildberries (WB) provided full-chain services for Bazhou industrial belts, with new stores hitting **¥60,000 ($8.3K) daily sales*.

Table: Three Core Functions of Cross-Border E-Commerce in Electromechanical Exports

IV. Discourse Power Battle: From "Equipment Vendor" to "Standard Setter"

To break Western monopolies in mechatronic standards, Chinese firms must advance on three fronts:

-

Hardware Layer: Only 7% of discrete manufacturers reach Level 3 (Integrated) smart manufacturing. Modular integration—like System’s cable-reducing design that cuts signal interference to 0.01% (vs. industry’s 1.2%)—is critical.

-

Protocol Layer: Li Mingtao, National E-Commerce Expert, advocates building trade-logistics hubs integrating airports and China-Europe freight trains. Deeper protocol penetration is key—when System’s OPC UA interfaces become Southeast Asia’s default, Chinese standards replace German DIN norms.

-

Ecosystem Layer: Zhang Yansheng urges establishing a "Global Networked Production (GNP) system" to capture overseas digital value. A Shenzhen machinery firm earns ¥8M ($1.1M) annually from cloud-based PLC programming services via Alibaba.com—surpassing hardware profits.

V. The Future Battleground: Service Premiums & Total Factor Productivity

The endgame lies in total factor productivity (TFP) gains. As Zhang Yansheng notes: "New-quality productive forces focus on drastic TFP growth, not just high-tech development."* This demands triple transformation:

-

Profit Model Overhaul

Hardware sales should dip below 50%, with services (protocol licensing, cloud platforms, predictive maintenance) as new pillars. A Chinese servo brand’s "free controller + protocol subscription" model in Poland boosted client retention to 92%. -

Technology Convergence

Only 7% of electronics firms enable AI-aided decisions. Embedding AI into motion control—e.g., motor lifespan prediction algorithms—could cut maintenance costs by 40%. -

Global Rule Engagement

Driven by Wildberries and Amazon, Hebei’s Bazhou hardware belt is co-drafting the Light AGV Safety Guidelines—the first international standard incorporating Chinese collision-avoidance algorithms.

Conclusion: Defining Industry’s "Universal Language"

When System engineers debug AGVs in Jakarta, their screens display not just motor curves but China-standard equipment health models. From Hangzhou’s cross-border e-commerce zones to Southeast Asian smart factories, a war to define industry’s "universal language" has begun.

As that Southeast Asian client noted: "German controllers are like Swiss watches— but Chinese solutions are smartphones that make systems come alive."* As hardware, protocols, and services converge, whoever masters mechatronics’ full-stack logic controls smart manufacturing’s neural network.

The road is arduous—69% of Chinese manufacturers remain at smart manufacturing’s starting line. Yet history shows: every industrial discourse shift begins with trickles of innovation and culminates in surging rivers of standards. And cross-border e-commerce ecosystems are turning those trickles into a transformative tide.